How to report a foreign gift and meet legal obligations

Everything about Reporting a Foreign Gift: Legal considerations and vital steps

Reporting foreign gifts involves a complex set of guidelines and policies that organizations should navigate very carefully. Comprehending the specific thresholds and called for paperwork is essential for conformity. Failure to stick to these criteria can result in significant penalties. As companies significantly get international payments, the importance of understanding these legal factors to consider becomes critical. What are the prospective repercussions of non-compliance, and just how can entities successfully handle their international present reporting obligations?

Recognizing International Presents and Their Ramifications

International gifts, frequently considered as tokens of goodwill, can bring substantial ramifications for receivers, particularly within scholastic and governmental organizations. These gifts, which might consist of monetary contributions, scholarships, or product assistance, can influence the recipient's connections with foreign entities and governments. The nature of the gift frequently questions relating to autonomy and possible problems of interest.

When approving foreign presents, establishments should navigate the complex landscape of legal needs and ethical factors to consider. The inspirations behind these gifts can differ, with some meant to foster partnership and others potentially targeted at progressing certain political or ideological agendas.

Coverage Thresholds for Foreign Present

Reporting limits for international presents are crucial for making sure compliance with economic reporting demands. Recognizing the interpretation of a foreign gift aids clarify what needs to be reported and under what scenarios. This section will outline the suitable reporting thresholds that companies must comply with when getting international presents.

Meaning of International Presents

Gifts got from outside the country are classified as international presents and can have specific ramifications for receivers. A foreign gift normally describes any kind of thing of value-- money, substantial residential or commercial property, or solutions-- offered by a foreign entity or person. The definition includes gifts from international federal governments, corporations, or people, and the nature of the gift can vary extensively. Notably, the value of these gifts may be subject to reporting requirements depending upon established limits. Comprehending the difference in between residential and international gifts is crucial, as it influences the recipient's responsibilities and prospective tax obligation effects. Recipients need to continue to be vigilant relating to the resource and value of gifts to ensure conformity with pertinent regulations associated with foreign presents.

Financial Reporting Requirements

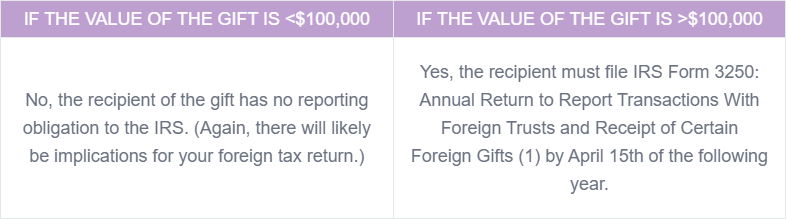

Relevant Coverage Thresholds

Understanding appropriate coverage limits for international presents is vital for conformity with economic regulations. Usually, the U.S. Internal Revenue Solution (IRS) mandates that any kind of foreign present surpassing $100,000 must be reported by individuals. For entities, the threshold is reduced, at $10,000. These limits relate to presents obtained from international individuals or organizations and encompass money, residential or commercial property, and various other assets. Failure to report gifts that go beyond these limitations may lead to penalties, consisting of fines. It is important for recipients to preserve exact records and assurance timely submission of needed types, such as Type 3520 for individuals. Recognition of these limits assists protect against unintentional infractions and advertises transparency in monetary ventures with foreign sources.

Required Forms for Reporting Foreign Gifts

Conformity with policies surrounding foreign presents is essential for organizations receiving such payments. To ensure appropriate reporting, establishments have to make use of certain kinds mandated by the U.S. Department of Education And Learning. The main form required is the "Foreign Gift Coverage Form," which captures important details about the present, including the donor's identification, the amount, and the objective of the gift. Organizations must also supply context regarding exactly how the funds will be utilized within the organization.

In addition, if the present goes beyond the reporting threshold, it is necessary to report it within the specified timespan, commonly within 60 days of invoice. Organizations might likewise require to maintain complete paperwork to sustain the info offered in the kinds. Stopping working to complete the required kinds precisely can result in penalties and impede the institution's capability to approve future international contributions. As a result, adherence to these requirements is crucial for legal conformity and institutional integrity.

Tax Obligation Factors To Consider for Receivers of International Presents

While international presents can offer considerable financial support for establishments, they also include specific tax obligation ramifications that receivers need to navigate. The Internal Earnings Service (IRS) mandates that any type of united state person obtaining foreign gifts exceeding a particular threshold needs to report these gifts on Kind 3520. This reporting is important to stay clear of fines and guarantee compliance with U.S. tax legislations.

Receivers should understand that while getting an international gift is usually ruled out taxed income, the reporting demand still uses. In addition, the tax obligation implications may vary depending on the nature of the gift, whether it is financial or building. If they are substantial, foreign gifts can also influence the recipient's estate tax obligation responsibility. Therefore, it is recommended for receivers to get in touch with tax professionals to understand their obligations completely and to guarantee correct reporting and compliance with all relevant policies.

Repercussions of Falling Short to Report Foreign Present

Falling short to report international gifts can cause considerable consequences for recipients, as the Irs (IRS) enforces strict charges for non-compliance. Recipients might face considerable monetary consequences, including fines that can rise to 25% of the unreported present's value. Additionally, the internal revenue service maintains the authority to impose rate of interest on any type of unsettled tax obligations associated with the foreign present, in addition exacerbating the financial worry. Non-compliance can additionally cause audits, resulting in a lot more substantial analysis of the recipient's financial tasks. In extreme instances, people may undergo criminal fees for unyielding neglect in coverage, resulting in prospective jail time. Failing to abide can damage one's trustworthiness and credibility, affecting future economic opportunities and connections. Generally, the value of sticking to reporting requirements can not be overstated, as the implications of neglecting this task can be damaging and far-reaching.

Best Practices for Compliance and Record-Keeping

Effective conformity and record-keeping are essential for taking care of international gifts. Organizations should concentrate on preserving exact paperwork, establishing clear coverage treatments, and conducting regular compliance audits. These ideal techniques assist guarantee adherence to policies and minimize explanation possible threats connected with international donations.

Preserve Accurate Paperwork

Exact documents is vital for companies obtaining foreign gifts, as it guarantees conformity with institutional policies and legal requirements. Keeping detailed documents entails recording the information of the gift, consisting of the benefactor's identification, the quantity or worth of the present, and any conditions affixed to it. Organizations should also track the day of receipt and the objective for which the gift is intended. It is recommended to classify gifts based upon their nature, such as cash, residential or commercial property, or services, making certain that all pertinent papers, such as arrangements and communications, are kept safely. Routine audits of documentation can even more enhance conformity initiatives, helping to recognize any type of disparities and guaranteeing that the company is gotten ready for possible questions or reporting obligations.

Develop Clear Reporting Procedures

Establishing clear reporting procedures is vital for organizations to guarantee conformity with guidelines bordering foreign gifts. These procedures need to describe that is in charge of reporting, the particular info needed, and the target dates for entry. It is vital to produce a structured process that includes training for staff on identifying and reporting international presents properly. Organizations ought to additionally designate a compliance officer to oversee the reporting procedure and function as a point of contact for questions. Additionally, carrying out a central system for tracking and recording foreign presents can improve transparency wikipedia reference and liability. By developing these procedures, companies can minimize the risk of non-compliance and guarantee they satisfy all lawful requirements efficiently.

Regular Conformity Audits

Normal compliance audits are an important part of maintaining adherence to foreign gift guidelines. These audits help establishments guarantee that all gotten gifts are precisely reported and recorded in accordance with legal requirements. Ideal practices for carrying out these audits consist of establishing a clear routine, involving qualified employees, and using thorough lists that cover all relevant reporting requirements. Organizations need to likewise keep in-depth documentation, consisting of document pertaining to international gifts and records of prior audits. Constant training for team involved in reporting processes can enhance understanding and conformity. Furthermore, implementing rehabilitative action plans for recognized discrepancies can enhance adherence to guidelines and mitigate possible lawful threats. Normal audits cultivate a society of transparency and accountability in taking care of foreign presents.

Regularly Asked Concerns

Can I Report an International Gift Anonymously?

Coverage an international gift anonymously is usually not possible, as laws often require recognition of the contributor. Openness is emphasized to assure compliance with lawful demands and to mitigate prospective dangers related to undisclosed international contributions.

What if My Foreign Gift Is a Car Loan Rather?

If the foreign present is a car loan, it needs to be reported in different ways. Fundings generally entail settlement terms and might not drop under the same reporting needs as gifts, requiring careful evaluation of appropriate guidelines.

Are Foreign Gifts Received by Minors Reportable?

International presents gotten by minors are normally reportable, comparable to those gotten by grownups. report a foreign gift. The obligation to report depends on find out this here the present's value and the particular guidelines governing international gifts within the recipient's jurisdiction

How Can I Prove the Source of an International Present?

To show the resource of an international present, one need to get documents such as bank statements, present letters, or contracts. This evidence assists establish the origin and legitimacy of the items or funds received.

Can Foreign Gifts Effect My Migration Standing?

Foreign presents usually do not influence immigration standing directly; however, substantial presents might question throughout visa applications or evaluations. It is essential to guarantee compliance with appropriate regulations to avoid prospective issues.

Numerous people and companies should stick to details financial reporting demands when receiving foreign gifts, specifically when these presents go beyond established limits. The primary form needed is the "Foreign Present Coverage Kind," which records important information regarding the gift, including the donor's identity, the amount, and the function of the gift. The Internal Earnings Solution (INTERNAL REVENUE SERVICE) mandates that any United state person receiving international gifts surpassing a certain threshold needs to report these gifts on Type 3520. To confirm the resource of an international present, one need to obtain documents such as financial institution declarations, present letters, or agreements. International gifts normally do not impact immigration condition straight; nevertheless, substantial presents may elevate inquiries during visa applications or reviews.